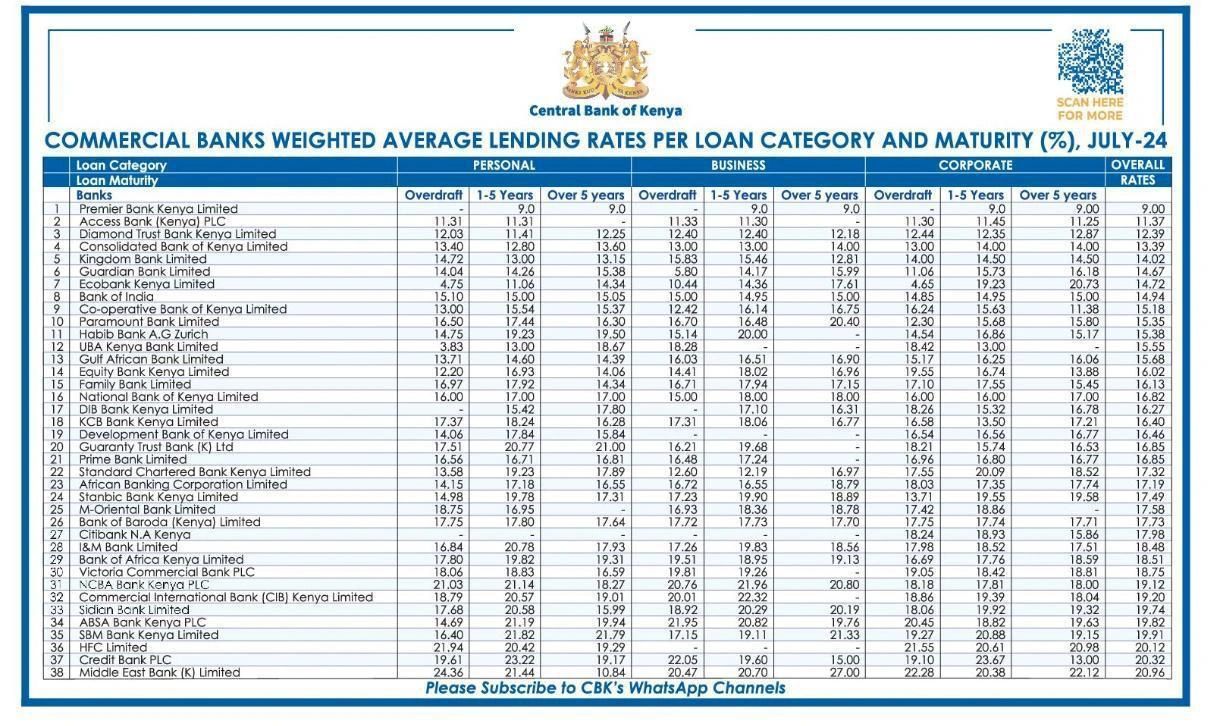

In a recent report from the Central Bank of Kenya, Kingdom Bank has been ranked as one of the top five banks in the country offering competitive loan rates.

With an average lending rate of 14.02%, the bank is positioning itself as a leading option for individuals and businesses seeking affordable credit solutions.

Why Kingdom Bank Stands Out?

For those in need of financial support, here are several compelling reasons to consider our services:

- Attractive Personal Loan Rates: We offer highly competitive personal loan rates with attractive benefits for borrowers. With their salary check-off loans, one can access up to Ksh 6 million and enjoy the flexibility of a repayment period extending up to 120 months. This extended term means you can benefit from lower monthly payments, making it easier to manage your finances without undue strain.

Additionally, the bank offers the option to buy off loans from other financial institutions, including registered microfinance entities. This means you can consolidate your existing debt and potentially reduce your overall repayment burden.

- Flexible Business Loans: Business owners can benefit from our range of business loans, which include both short-term and long-term options. The bank offers flexible repayment terms and favorable conditions, such as cash cover—allowing businesses to borrow against their existing savings or deposits with the bank. This flexibility supports effective cash flow management and business growth.

For property owners, Kingdom Bank provides landlord loans specifically designed for those whose monthly income is generated from rental properties. These loans are structured to support business needs while aligning with the income flow from rental activities.

Additionally, Kingdom Bank is a trusted partner for asset financing, offering up to 90% financing for assets with terms extending up to 72 months. This includes financing for commercial vehicles and equipment & machinery.

- Support for MSMEs: Kingdom Bank is also focused on supporting small and micro enterprises. The bank offers specialized micro loans, including “chama” loans and “miliki moti” loans. These products are designed to assist MSMEs in leveraging on their social capital as well as acquiring essential assets, such as motorbikes, tuk-tuks, and 7-seater matatus (Marutis), thereby fostering business expansion and operational efficiency. Additionally, the bank supports women entrepreneurs with tailored financial products that address their specific needs, helping to close the gender gap in business through the Faidi Dada financing solution.

- Convenient Digital Loan Solutions: Reflecting on the modern need for convenience, we also extend the KB Mobile Loans accessible on the KB Mobile App and on *344#. These solutions enable customers to apply for, access and manage their loans online, providing greater flexibility and ease of use.

Why opt for Kingdom Bank?

Our July 2024 ranking in the Central Bank’s report underscores our dedication to providing affordable and flexible financial solutions. By offering competitive rates and a range of tailored loan products, the bank aims to support both individual and business financial needs effectively.

For those interested in exploring our loan offerings, we invite potential customers to get in touch. For more information, call 0709 881 300 or visit any of their branches.